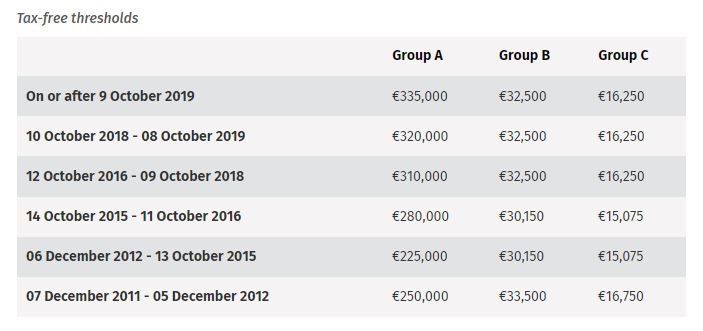

Capital Acquisitions Tax Thresholds

Group Thresholds for Gift Tax and Inheritance Tax

Overview

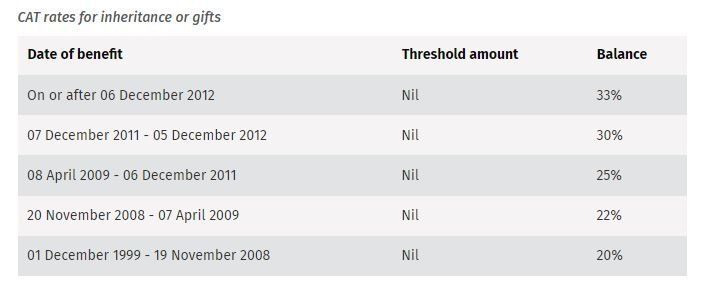

To calculate CAT you need to know which threshold, tax rate and aggregation rules apply to a gift or inheritance. You also need to know two important dates:

- the date of the gift or inheritance, which determines the relevant threshold and rate of tax

- the valuation date, which determines the relevant pay & file period.

This section explains the thresholds, tax rates and aggregation rules that apply to a gift or inheritance.

A beneficiary must make a Self-Assessment Capital Acquisitions Tax (CAT) IT38 Return, if the taxable value of the gift or inheritance exceeds 80% of the relevant group threshold. You must include all other taxable gifts or inheritances taken from any source within the same group threshold, on or after 5 December 1991.

You pay Capital Acquisitions Tax (CAT) on the total of all taxable gifts and inheritances received since 5 December 1991. The rules on how to calculate prior benefits are the aggregation rules.

Current CAT aggregation rules

These rules apply from 5 December 2001.

Aggregation rules for a gift or inheritance are those that apply at the date of the gift or the date of the inheritance.

The valuation date, which determines the due date for CAT, is not relevant to aggregation rules.

To calculate CAT on the latest benefit, add all gifts or inheritances received within the same group threshold since 5 December 1991:

- Identify the group threshold applicable to the current benefit.

- Add together the taxable value of all prior benefits received under this group threshold since 5 December 1991.

- Calculate the unused balance of the group threshold.

- Subtract this amount from the value of the current benefit.

- This is the excess amount you must pay tax on.

Group A - €335,000

The Group A threshold applies where you, the beneficiary, on the date of the gift or inheritance are:

- a child of the:

- disponer

- disponer’s spouse or civil partner (commonly known as a stepchild)

- a minor child, under 18 years of age, of a deceased child of the:

- disponer (commonly known as a grandchild)

- disponer’s spouse or civil partner (commonly known as a step-grandchild)

- a minor child of the spouse or civil partner of a deceased child of the:

- disponer

- disponer’s spouse or civil partner

- a parent of the disponer and you take an absolute interest (that is, not a limited interest) of an inheritance on the death of your child.

Group B - €32,500

The Group B threshold applies where you, the beneficiary, on the date of the gift or inheritance are:

- a parent of the disponer, where you take a gift or a limited interest

- a brother or sister of the disponer

- a child of a brother or sister of the disponer (Favourite Nephew or Niece Relief may apply)

- a child of the civil partner of a brother or sister of the disponer

- a grandparent of the disponer

- a grandchild of the disponer

- a lineal ancestor or a lineal descendant of the disponer.

Group C - €16,250

The Group C threshold applies where you, the beneficiary, on the date of the gift or inheritance have a relationship to the disponer not already covered in Groups A or B. (Includes a grandnephew or grandniece)