Latest News

I have a cousin who bought his forever home in Belfast. He's a really keen golfer and the house backed out onto the 14th green of the golf course where he is a member. What did he do? He only went and told the estate agent that he was a member of the club and couldn't wait to open a gate in the fence to access the course! And that was when the the agent knew he had him! Here's the thing : it can be so "bloody" difficult to find the home of your dreams and to secure your mortgage, that many purchasers will blurt out everything but their shoe size to the estate agent in their excitement - including the amount of their loan offer. Whether you’re buying a new home or a second hand home, it is extremely likely that the selling agent will ask you for evidence that you have the money to purchase the property. They will ask you for “proof of funds”. It makes sense doesn’t it? The agent wants to be sure that you will be able to complete the purchase. In all fairness, it’s not an unreasonable request. The loan approval letter from your bank will confirm the amount of the loan you’re approved for. It doesn't take a genius to figure out how much you can spend on the property. When bidding on a second-hand property, is that really something you want the agent to know? Think of a different situation. If you go out to buy a car, will you tell the car dealer how much money you have to spend before you start your haggling? (If you've answered yes to that question, I have a good friend who is a VW dealer and will be delighted to meet you!) Seriously though, it's hard enough to get a deal done for your new home without showing your hand to the estate agent. There are other ways of showing that you have the spending power without disclosing how much you have to spend. 1. If you are going to be our client, we will be happy to provide a letter of comfort to an estate agent, confirming that we have seen your letter of approval and that we are satisfied that you have the money - but without divulging how much you have available to you. We don't charge for that, it's all part of our service. 2. If you are using a mortgage broker, your broker may be able to provide you with a letter confirming that you have the funds available to purchase the property, 3. You could show the agent a copy of your letter of approval with the figures blanked out. Dealing with an estate agent is like any negotiation and as such it can be like a game of poker. The big difference is that it's probably the biggest hand you will ever play for, so by holding back the amount of your loan approval you might just be keeping a very valuable card in your pocket. If you would like us to provide a letter of comfort for you, feel free to give us a call. Anything we can do to help!

Have you ever heard this proverb? “In the land of the blind, the one-eyed man is king.” It means that someone in a weaker position will trust someone who they perceive to be in a stronger position. Or, it can mean that someone with little knowledge can trust someone who they perceive to have more knowledge. There is another proverb I like…. from Russia: “Doveryai, no proveryai”. It means ”Trust but Verify”. When a financial institution is selling you a product, it might very well be the best product for you. You should however fully check and verify that it is. You can only do that by doing your own research and comparisons. Remember too, that the bank will only offer you options from their own insurance partner(s). One of the areas in which we see widespread confusion and reliance on financial institutions is in the area of Life Assurance and Mortgage Protection Assurance. Both are types of life assurance but they are fundamentally different. When you obtain your home loan, you will be required to take out a life policy. You must then assign the policy to your bank to ensure that your loan is fully paid off in the event of your death. Life Assurance can often seem like a casual add-on to your mortgage application, but you really should give it careful consideration. As you know, we don’t provide financial advice, but I’d like you to understand the key differences in the two main types of cover available and our clients’ experiences. The two types of cover we come across most often are Mortgage Protection Assurance and Level Term Assurance. Let’s assume your loan is €300,000 over 35 years. You will need cover of €300,000 for at least 35 years. Mortgage Protection Assurance covers the outstanding balance of your loan throughout the term. God forbid, if you die in year one the insurance company will pay out almost €300,000. If you die in year 34 the payout might only be €10,000 if that is the outstanding balance. There won’t be any money left over after your loan is paid off. We’ve had more than one client who innocently thought that they would receive a payout on the tragic death of a spouse or partner, only to find that their loan balance was the only thing covered. That can be hard to witness. Level Term Assurance covers a fixed amount throughout the term of the policy. If you die in year one, they will pay out €300,000. If you die in year 34, they will still pay out €300,000. The loan will be paid from the proceeds of the policy and the balance will be paid to whoever you nominate as your beneficiary. Mortgage Protection Assurance is inevitably cheaper because the risk to the insurance company is less since the payout is likely to be less. Sometimes clients automatically go for the cheaper option without fully understanding the implications. Sometimes clients have difficulty in obtaining life assurance because of health issues. We saw an increase in that during the pandemic and it is difficult and heartbreaking to see the added stress that this causes clients who are already dealing with an illness. Many first-time buyers will eventually trade up to buy something else. At that time, they will need suitable life cover for their new loan. As they get older, the cost of insurance becomes more expensive, and the likelihood of an underlying illness also becomes greater. We’ve seen situations where clients could not move because they could not obtain life cover. The type of insurance you take out is entirely up to you, but we often advise clients to consider taking out a policy which will cover them in the event that they need “fresh” cover for a new loan in the future. In other words, to take out a policy which they can bring with them to their new loan. Let’s say that 15 years after taking out your initial loan for €300,000, you trade up and require a new loan for €300,000. If you had taken out a level term policy for 35 years to cover your first loan, you will still have 20 years remaining on that policy which you can use as cover for your new loan. With mortgage protection insurance, you simply won’t have that level of cover - and if you’ve developed a medical condition, you might not be able to get it. Clients sometimes ask whether their occupational or work-related life cover will satisfy the banks’ requirements, but it rarely does. That’s mainly because people can change jobs and the policy will cease when they move. There are far more types of policies and add-ons out there for me to explain but I recommend that you check out this really great Jargon Buster from Lion.ie. Like ourselves, Lion try to educate their clients to make the best decisions. Here’s the link. So, don’t just trust that nice lad in the bank to sell you the most suitable product for you and your family. “Doveryai, no proveryai” as they say in Novosibirisk. (No, I’ve never been!)

Neighbourhood Knowhow Most people can see their dream home in their mind’s eye… but what about the neighbourhood it's located in? No house exists in a vacuum and your quality of life will depend as much on your neighbourhood as your home. That great “bargain” will lose its charm if you can’t step outside your door at night. So, if you find yourself house hunting in an unfamiliar area, here are some tips to help you judge the locality. Neighbourhood Watch... You’re not just buying a house, you’re also investing in those living nearby – for better or worse! Trying to figure out who lives next door can be tricky at the best of times, but there are a few subtle ways to go about it. Call next door for a quick (socially distanced) chat. Most people will be pretty helpful if you just explain that you’re thinking of buying the house next door. It’s a chance to “ask them about the area” while finding out what they’re really like. Are Houses Well-Maintained? Nice gardens, recently-painted boundary walls, pristine exteriors, and skips are all positive signs. While skips usually come with building noise, which is a pain in the short term, their presence indicates refurbishment works and might signify house proud inhabitants. Overall, it’s encouraging. Comparatively, litter-strewn streets and unkempt front gardens can speak volumes about how invested the locals are in the community. Are these mostly rental properties with potentially a high tenant turnover? On The Up, Or Going Downhill? Now that you’ve ascertained what’s happening in the direct vicinity of your desired home, what about the wider area? Things you should keep watch for include... 1. Dilapidated houses 2. Vacant properties 3. Places with “For Sale” signs 4. Shops or local businesses that have closed down If you notice any of the above, consider doing extra research on the area to help you figure out whether the neighbourhood is improving or going backwards. Signs of Criminality It pays to drive around the neighbourhood after dark to see what it’s like when the sun goes down. In addition to noticing real-time antisocial behaviour, keep your eyes peeled for the following… 1. Beer bottles cast aside in local green areas or outside vacant properties. It could be that they’re commonly used as drinking dens by anti-social elements. 2. Look out for security bars on windows or doors 3. CCTV cameras on private residences. If this is a theme, it’s safe to assume they’re there for a reason. Researching an area online can throw up all manner of relevant and influential information – from a news report on crime, to a feature on the efforts of the local Tidy Towns Committee. Having a nose around Google Maps or searching for the street or estate name via Twitter could also provide an insight into the area. Another good resource is the planning section on your local authority's website. That can give you good information about what can be expected in the area in the future. Simply put, there’s no way to investigate absolutely everything about a place prior to purchase. However, doing your homework – and knowing the things to look out for – can certainly minimise the risk.

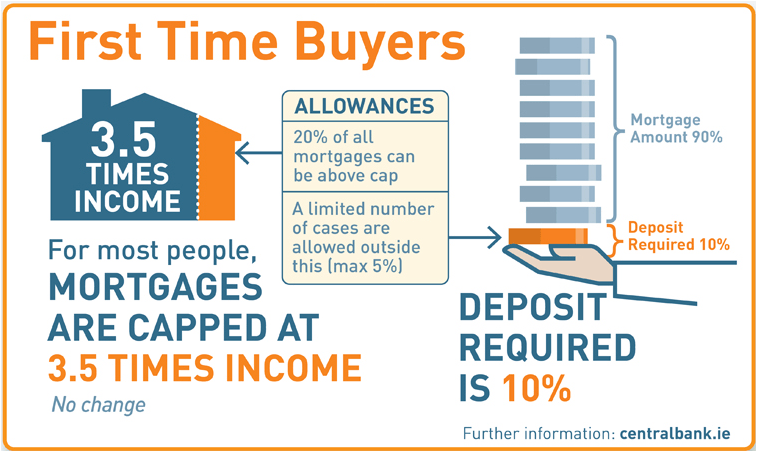

I want to tell you a little story, showcasing just how bonkers lending was in Celtic Tiger Ireland and ultimately how the Central Bank lending rules came about. In the mid-noughties, the banks went a little bit, well, NUTS. In short, pretty much anyone could get 100% mortgages to buy property. In some cases, lenders would throw in extra funds for a leather suite, a hot tub, or a brand new car for the drive... In 2005, a friend of mine (let's call him Pat) was driving his delivery van through a provincial town, whereupon he was waved down by the manager of a well-known bank. This bank manager was standing on a footpath, outside his bank (really! I kid you not!), merrily waving a sheaf of estate agents' brochures for Land, Commercial Property, Residential Property, and property abroad. So, Pat pulled over to see what this guy was so excited about. Popping his head through the window of Pat's van and dropping the brochures onto Pat's lap, the bank manager declared: "If you want to buy any of these properties Pat, I'll have the money for you before this evening!" Pat couldn't believe it. Potentially easy millions to buy land in South Tyrone, a factory unit in Roscommon, or a block of sea view apartments in Kuşadasi? What could possibly go wrong?! After all, if banks were happy to lend large sums while property prices were rising, who was Johnny to second guess them? To be clear, Pat was no fool. Before returning to the bank manager, he made an appointment to see his accountant. While this accountant was perhaps a little behind when it came to new-fangled financial schemes, he had a wealth of old fashioned wisdom. "Pat", he said. "What do you know about Kuşadasi?" "Honestly? I've never heard of it," replied Pat. "OK. So, what DO you know about, Pat?" "Frozen chickens," said Pat. "And football." "Well then", this Accountant Yoda quickly surmised, "Stick to selling frozen chickens and going to football matches, Pat. Forget Kuşadasi." Thankfully Pat took that wise advice but this is merely a snapshot of the sort of nonsense that was happening in towns all across Ireland circa 2005. When the banks crashed in 2008, our Central Bank trotted back to its stable, uncomfortably bolting the door behind it. Only afterwards did it introduce sensible limits on lending... Banks could only lend 3.5 times the income of First-Time Buyers. Additionally, they couldn't lend more than 90% of the property value. Exceptions To The Rule... The Central Bank’s more sensible approach still allows for a portion of discretionary lending – deemed "exceptions" or "exemptions." For example, 20% of all mortgages can surpass the 3.5 times income cap, while 5% of mortgages can be for loans greater than 90% of the property value. Exceptions are usually available to borrowers who have decent long-term prospects but perhaps can't fulfill the normal Central Bank criteria at the time of looking for a mortgage. These candidates typically include young professionals, state employees on-increment scales, and so on. In such instances, banks can lend a higher multiple of a First-Time Buyer's income, or greater than 90% of the property value. In the first few years exceptions were often fully taken up in the early part of the year. You had to be quick out of the starting blocks to get an exception, such was the demand. However, as with most things in 2020, things are different – and not in a good way if you're looking for an exception. The banks have dramatically cut back on exceptions, with some ceasing them entirely. The vast majority of loans this year have been within the normal Central Bank limits. In short, if you require an exception, it might be tricky but not impossible. Most likely however, you will need a good mortgage broker to negotiate on your behalf. Unless you're married to a bank manager, that is...

It's been tough. The news has been filled with stress and sadness, and we're all missing our friends and family after months (and months!) of social distancing. All of us have had to adjust to a brand-new way of life full of Zoom meetings and remote learning and mask wearing. We've never been quite so ready to flip the calendar to welcome a new year. New Year - New Hope! Scientists now have better tests and treatments, and are forging a clear pathway out of this global ordeal. With mass vaccination on the way we can live in hope that we will return to our normal lives sooner rather than later. Hopefully too, this year will be the year that you secure your new home. A huge (and relatively painless!) step in the right direction will be to obtain Approval in Principle (AIP) for your home loan. What is Approval in Principle? Approval in Principle is an indication from a lender of how much they will be prepared to lend to you based on the information you provide to them. Getting AIP means you will know whether you will get mortgage approval and will give you an idea of the amount you can borrow. It’s not the official loan offer but it is usually the basis of the official loan offer. Why get it now? There are lots of advantages to having your AIP sorted as soon as possible. Here are just a few of them: You can look for your new home with confidence that you will get loan finance when you need it. Your official loan offer will issue more quickly if you already have AIP. Estate agents are more likely to consider your offer if you already have AIP. Vendors want to know that you have your funds available. This has become increasingly important and many agents wont even consider an offer if you don't have AIP. You can act quickly if an opportunity to purchase comes up. No need to go back to the bank before making an offer. You will know what paperwork your bank requires and will avoid “surprises”. If you need a mortgage exception you are more likely to get it by getting your AIP early and before the banks’ exceptions run out. Having AIP does not commit you to a loan from a bank. In fact, you can have AIP from multiple banks. AIP typically lasts for 6 to 12 months depending on the lender. You can seek an extension if you need it. You can get AIP even before you have your deposit saved if you can show that you will have the deposit when you need it. Make that Resolution! So, grab a piece of paper and a pen and write down “In 2021, I will get my Approval In Principle sorted”. Stick it to your fridge! Pick up the phone to the banks or to a trusted broker, and make 2021 the year that you keep your new year’s resolution!

Mark Twain once said that “a banker is a fellow who lends you his umbrella when the sun is shining, but wants it back the minute it begins to rain”. Wasn't he ahead of the game! Those of us who were around in 2008 feared the worst when mortgage lending crashed in the Spring lockdown. We thought the banks would put the brakes on mortgage lending, but it’s not as bad as we thought it would be. Some might say that lenders have been surprisingly patriotic and supportive. Mortgage lending is certainly down year-on-year but it’s steadily recovering lost ground. Home loans are still great business for the banks if they can find the right people to lend to. If a bank can lend you money and be pretty damn sure of getting it back with interest they will absolutely want to talk to you. If you’re lucky enough to have been unaffected by the pandemic you shouldn’t have any great difficulty in getting a mortgage providing you meet the usual criteria. There is definitely a longer approval process between applying for a loan and getting it. That is caused by tightening of conditions, greater scrutiny of loan applications and increased referrals to credit committees. If you’ve already been approved for your loan you will need to show that you can still afford it when you’re drawing down your money. That can cause delays in drawing down your bank loan when you need it to close your purchase. The banks will want to ensure that your financial situation has not changed adversely in the window between approval and drawdown. Your lender will probably want to see your most recent pay slips and bank statements just before they release your loan cheque. They will want to see that you’re still earning the same money. If you’re not, they can refuse to release the funds. Because of the extra checks the banks carry out, closing a purchase generally takes a bit longer than it used to. A year ago we could request a client’s loan funds on a Monday and have the money in our account on Tuesday! This year we might not get your money for two weeks - bear that in mind before you hire the removal van. Nearly every loan offer that we see contains a new “Covid 19” clause giving the lender an opportunity to re-evaluate your circumstances and to reconsider their decision to lend. Still plenty of smart people in the banks to come up with special conditions! The bottom line is that there is a risk that you could sign your contract to purchase your home but not be able to obtain your funding because your circumstances have changed. Without adequate protection that could be a disaster for you. We now insist that every purchase contract signed by our clients contains a “subject to loan” clause. This gives you an “out” if you are unable to meet the bank’s conditions at drawdown. If you are unlucky enough to lose your job, or suffer a drop in earnings, having that clause in your contract means you can pull out - with no penalties or loss of your deposit - if the bank refuses to lend. If you’re on the Government Wage Subsidy you’re going to struggle to get your loan. Don’t be discouraged however. You may still be able to get your loan approval on condition that you are off the subsidy by the time you draw down your loan. Again it's vitally important to ensure that your contract contains a loan protection clause. In summary, the banks want to lend but they want to be really really REALLY sure that they will get their money back. If you can meet their lending criteria they will offer you all sorts of incentives to win you as a customer. Mostly it is down to certainty about your financial situation but if you can demonstrate to the bank that you are financially healthy and you are likely to continue to be financially healthy they will want to lend to you .

These are uncertain times. The whole world has been turned on its head! But life has to go on.. The vaccine rollout is gathering pace and there is great optimism that life will return to some form of normality in the near future. When COVID-19 first struck, the nervousness in people buying homes was notable. In March and April 2020, a significant number of people who had instructed us in their home purchases pulled out. They were panicked. They thought house prices would drop and they would end up paying too much for their new homes. It didn’t work out that way though, and most of them have come back to complete their purchases. Unlike 2008 when there was real trouble, the economy seems fundamentally sound. People still need somewhere to live and the demand for housing is stronger than ever. Simply put, competition for good properties has not abated – and I speak from personal experience. In October 2020, my mum sold our family home. I bid a sad farewell to the place where I grew up, salvaging a few dodgy 80s records and a badly battered Raleigh Scorpio bicycle before the movers arrived... So this was our experience : Mum’s house was “sale agreed” within a month of it being advertised • She found a new home within a few weeks at a price near the asking price • There was competition for both properties but it wasn't by any means frenzied. This reflects what we are seeing from our clients’ experiences. While there is no discernible drop in property prices, demand remains strong but people don’t seem to be losing the run of themselves. Properties seem to be making “their price” and while there have been bidding wars, they seem to be the exception rather than the rule. That's not to say nothing has changed. The supply of properties has contracted and there have been queues for homes in new developments. We’ve also seen a few clients purchasing properties a little further afield than they previously planned. This may be an early indication that the Working From Home phenomenon will be with us for the foreseeable. While we haven’t seen a massive race to the Wild Atlantic Way, purchasers may be casting their nets wider when considering location options. The Daft.ie Housing Market Reports from economist Ronan Lyons are informative and definitely worth a look. Here’s some headline analysis from Ronan’s most recent reports: 1. “The return to price growth in Q3 (2020) suggests that the disruption wrought by Covid -19 on the market as a whole was relatively short-lived” 2. “It is back to supply, supply, supply. The ultimate reason prices are rising again is that there are simply not enough homes in the country given the population and its demographics” 3. “COVID-19 is allowing people to move away from urban centres, because of the ability to work from home. It remains to be seen if such a shift in preferences in the housing market does take place; it is also worth remembering that urban centres offer not only employment opportunities but other benefits, including retail, leisure, and other amenities which people value – there is no support yet for the prediction that more rural or larger properties have seen their relative price increase since the start of the year. Given the steep rise in unemployment, we would have expected to see a fall off in demand for homes. Ronan addressed this paradox of rising prices in a time of high unemployment as follows: “That prices are rising at a time of severe economic dislocation undoubtedly reflects the uneven economic impact of Covid-19. In Ireland as in other countries , it is certain sectors – whose workers are disproportionately renters – that have been most affected. On average those with a greater number of years of formal education – especially where they work for larger employers – have if anything benefitted from the dislocation." As for what’s going to happen over the next few months, or years? Don't go on the hunt for a crystal ball because it won’t help you! Let's face it however; you’re not really looking for a financial investment – you’re looking for a home. Keep a close eye on the market and make sure that you get a feel for what is selling in the areas you would like to buy your home in. Until then, do check out Ronan Lyon's Daft.ie Market Reports. Yes, I’m a bit of a fan; he doesn't appear to have skin in the game, unlike some of the banks and estate agents.